Pedestrian Backover Accident: Jury Verdict in New London

In Jones v. Morocho, a December 2023 parking lot incident led to a significant legal battle over liability and pedestrian safety. The plaintiff, Venessa Jones, alleged she was struck by Francisco Morocho’s vehicle as it "suddenly reversed without warning" at 189 Jefferson Avenue in New London. While the plaintiff sought damages exceeding $15,000 for lumbar injuries and radiating pain, the defense successfully argued a "Special Defense." The jury ultimately sided with the defendant, concluding th...

Read MoreRecent Articles

Are You an Expert Witness?

Increase your visibility and get more cases

Top Areas of Law

Latest Verdicts & Settlements

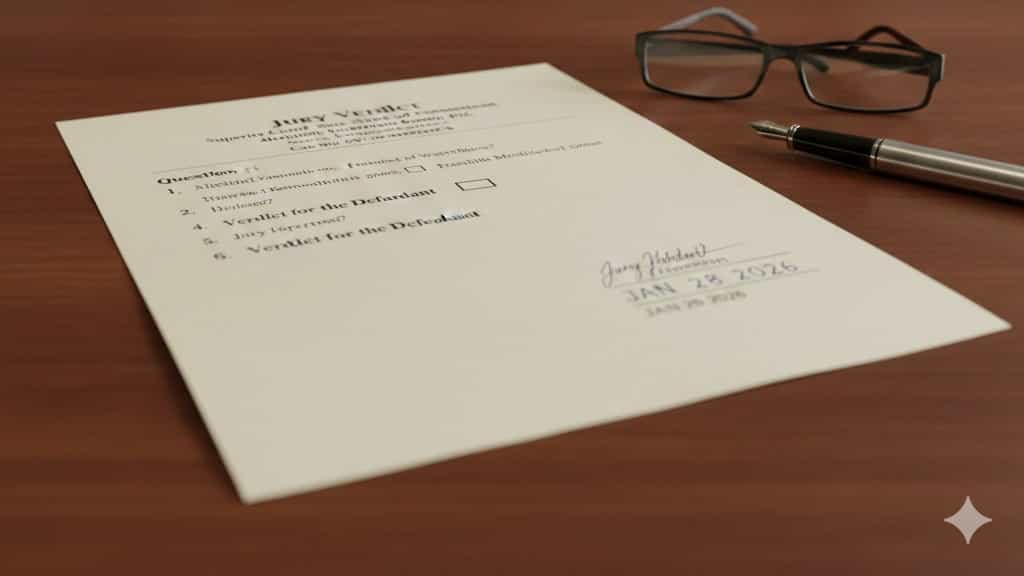

In Jones v. Morocho, a December 2023 parking lot incident led to a significant legal battle over liability and pedestrian safety. The plaintiff, Venessa Jones, alleged she was struck by Francisco Morocho’s vehicle as it "suddenly reversed without warning" at 189 Jefferson Avenue in New London. While the plaintiff sought damages exceeding $15,000 for lumbar injuries and radiating pain, the defense successfully argued a "Special Defense." The jury ultimately sided with the defendant, concluding that the plaintiff failed to maintain a proper lookout for her own safety, resulting in a zero-dollar award and a full defense verdict in January 2026.

Sohini C.

Sohini C.

$1.16 Million Florida Ambulance Crash Jury Verdict

March 6, 2026

On August 26, 2023, Christopher Campbell traveled eastbound on North River Drive in Miami-Dade County when his vehicle was struck by an ambulance owned by Randle Eastern Ambulance Service (AMR) and operated by Cesar Uribe Rivera. Campbell alleged that Rivera’s negligent driving caused him to suffer permanent bodily injuries, disfigurement, and a significant loss of quality of life. While the defense argued that Campbell contributed to the accident by failing to wear a seatbelt and being distracted by a cell phone, the jury ultimately assigned the majority of the fault to the ambulance driver. After deliberating on the evidence of medical expenses and long-term suffering, the jury returned a gross verdict of $1,160,000, ensuring Campbell received compensation for his ongoing physical and mental anguish.

Sohini C.

Sohini C.

Following a catastrophic ten-story fall that resulted in a traumatic brain injury, Gabriel Reeves sought refuge and recovery at the Brooks Brain Injury Clubhouse. Instead of a safe haven, he encountered Eric Powell, a volunteer who used his position of trust to orchestrate a scheme of sexual exploitation. Under the pretense of helping Gabriel lose weight, Powell lured him into private offices to take nude "progress photos" and sent him sexually explicit messages. This betrayal shattered Gabriel's recovery, triggering severe behavioral setbacks, physical aggression, and a diagnosis of PTSD. While the facility argued these actions were outside their control, a Duval County jury held them responsible for the conduct of their apparent agent, awarding significant damages for the lifelong care Gabriel will now require.

Sohini C.

Sohini C.

In a significant victory for premises liability, Darryl Lee Williams successfully sued Portofino 472-21, LLC and AT&T Florida following a life-altering accident on July 31, 2019. While walking on a property in Homestead, Florida, Williams tripped over a hazardous cluster of exposed wires and cables. The impact resulted in grievous, permanent physical and mental injuries, including a loss of capacity to enjoy life. Despite AT&T’s defense that the hazard was "open and obvious" and that Williams was at fault , the jury found in favor of the Plaintiff. On September 3, 2025, Judge Peter R. Lopez entered a final judgment ordering Portofino 472-21, LLC to pay $14,000,000 in total damages, covering millions in medical care and future pain and suffering.

Sohini C.

Sohini C.

On August 13, 2019, William Santana was seated in his parked dump truck at the Zahlene Enterprises facility in Medley, Florida, when a heavy front loader operated by Alfredo Tellez struck his vehicle. The impact was severe enough to force Santana to leap from the truck to avoid further harm, resulting in permanent physical impairment and the aggravation of pre-existing conditions. The legal battle centered on vicarious liability and the dangerous instrumentality doctrine, as Santana sought to hold Zahlene Enterprises responsible for their employee’s failure to maintain control of the machinery. Despite defense arguments citing comparative negligence and pre-existing medical issues, a Miami-Dade jury found the Defendants 100% at fault. On August 29, 2025, the Court awarded Santana $71,666.00 for medical expenses and non-economic damages, including pain and suffering.

Sohini C.

Sohini C.

In the matter of Mancillas v. City of Ontario, a probationary customer service representative alleged she was wrongfully terminated in retaliation for reporting sexual harassment and requesting mental health leave. Mancillas claimed coworkers subjected her to misogynistic insults, referencing characters from "Jersey Shore," and that HR dismissed her concerns as being "antisocial." Despite her claims of a hostile work environment and violations of the Fair Employment and Housing Act (FEHA), the City maintained her dismissal was strictly performance-based. On September 3, 2025, a San Bernardino jury delivered a defense verdict. While acknowledging her protected activities, the jury concluded that her job performance was the "substantial motivating factor" and that the City would have made the same termination decision regardless of her complaints.

Sohini C.

Sohini C.

The legal battle in James Wesolowski v. Mitchell R. Savarese (Case No. 2019-009389-CA-01) stemmed from a 2018 confrontation at a North Bay Village Shell station. What began as a dispute over "jumping the line" escalated when Savarese struck Wesolowski in the face, causing permanent disfigurement and significant medical expenses. While Savarese argued self-defense claiming Wesolowski used racial epithets and aggressive gestures the jury ultimately found Savarese liable. In September 2025, the court entered a final judgment of $68,000, including $51,000 in punitive damages (adjusted for statutory caps) and $17,000 in compensatory damages, concluding over six years of litigation.

Sohini C.

Sohini C.

On Christmas night in 2022, a holiday gathering in Middletown, Connecticut, turned into a legal battle after a pit bull mix bit a guest in the face. Jared Lopez alleged that while he sat in the living room at 11:30 p.m., Nancy L. Newman brought the dog up from the basement, at which point the animal jumped onto his lap and attacked. The resulting injuries included permanent facial scarring and a loss of sensation in the lip. On January 21, 2026, a jury found Newman strictly liable under state law and awarded Lopez $12,831.50 in damages.

Sohini C.

Sohini C.

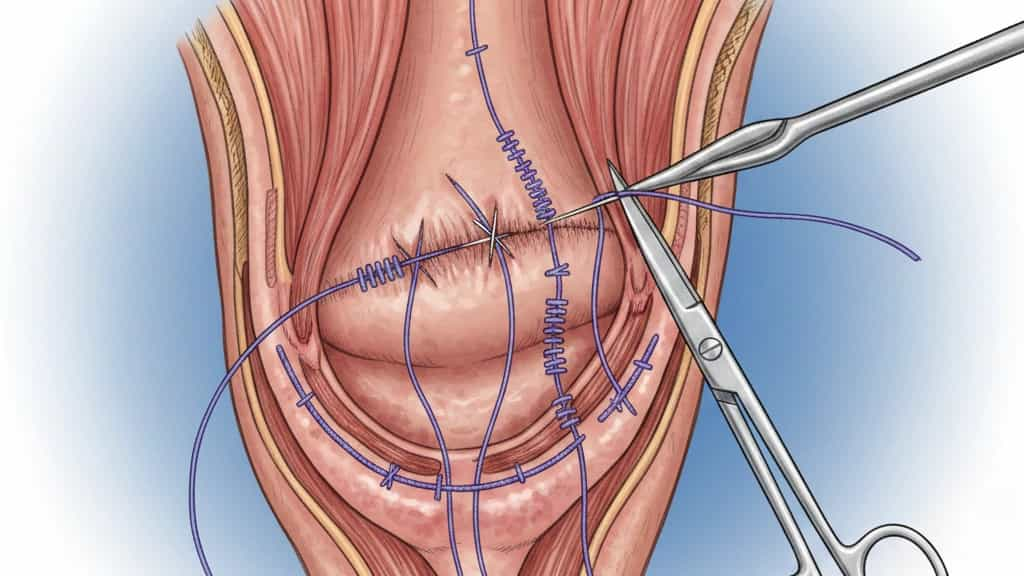

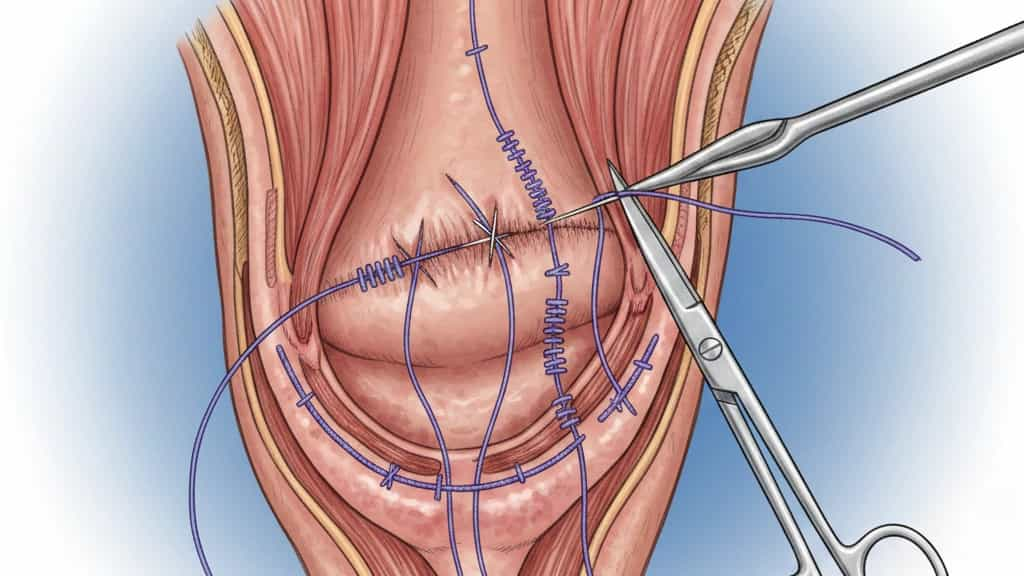

In May 2020, Michaela Nielsen underwent a vaginal delivery at HCA Florida Kendall Hospital under the care of Dr. Eric Runyon. Following the birth, Ms. Nielsen alleged that she suffered a significant clitoral and labial laceration that the medical team failed to diagnose or repair. The Plaintiff contended that this oversight led to physical disfigurement and required multiple corrective surgeries. However, the defense maintained that Dr. Runyon provided appropriate care and that the injury was not a result of medical negligence. After a multi-day trial in the 11th Judicial Circuit Court of Florida, the jury returned a complete defense verdict, finding that Dr. Runyon was not negligent in his treatment of the Plaintiff.

Sohini C.

Sohini C.

The legal battle between International Firearms South, Inc. and Glatze Militum, LLC concluded in a Miami-Dade courtroom after years of allegations involving missing funds and broken promises. International Firearms launched the lawsuit claiming that Yevgeniya Carita, acting for Glatze, had siphoned $400,000 from their joint venture bank accounts without permission. The plaintiff argued this was a clear case of conversion and a breach of fiduciary duty that crippled their business operations. However, the defense maintained that the plaintiff had failed to meet its own contractual obligations. In a sweeping decision, the jury found that International Firearms had not performed its essential duties under the agreement, nor was it excused from doing so. Consequently, the jury cleared the defendants of all charges, and the court ruled that the plaintiff would recover nothing from the suit.

Sohini C.

Sohini C.

In the matter of James Beers v. Tyler Peruta et al., the Connecticut Superior Court addressed a significant motor vehicle negligence claim stemming from an October 26, 2021, collision. The plaintiff, James Beers, alleged that Tyler Peruta negligently exited a private driveway at 319 Washington Avenue in North Haven, turning left into the path of his southbound vehicle. Beers reported a comprehensive list of injuries, including cervical disc protrusions, retrolisthesis, and chronic radiculopathy, which he claimed led to permanent physical impairment and lost wages. While the defense admitted that the vehicle was operated with the owner Donald Peruta's authorization, they staunchly denied all allegations of negligence. Following a trial before the Honorable LaTonia Williams, the jury returned a verdict on September 12, 2025, in favor of the defendants. The court entered a final judgment of no liability, resulting in no monetary recovery for the plaintiff.

Sohini C.

Sohini C.

Granby Tenant Loses Lawsuit Over Defective Handrail Fall

March 3, 2026

Carol Cruz, a tenant at 101 Meadow Gate Road in Granby, Connecticut, filed a lawsuit against her landlord, Halmar, Incorporated, following a traumatic fall on December 26, 2021. Cruz alleged that as she descended the interior stairs at approximately 11:45 p.m., she slipped and fell due to a non-compliant and dangerous handrail. The complaint detailed specific violations of state building and fire safety codes, claiming the 2 X 6 deck railing used as a handrail was too large to grasp and was positioned several inches lower than legally required. As a result of the tumble, Cruz suffered a fractured right hip and sought damages for medical expenses and permanent physical impairment. Halmar, Incorporated countered with a special defense, asserting that Cruz’s own negligence and failure to maintain a proper lookout caused the accident. On February 13, 2026, a jury in the Hartford Superior Court delivered a verdict in favor of the Defendant, Halmar, Incorporated, awarding no damages to the Plaintiff.

Sohini C.

Sohini C.On the Stand with Ashish Arun

A podcast on the law, practice and business of expert witness testimony. Listen to the latest episodes.